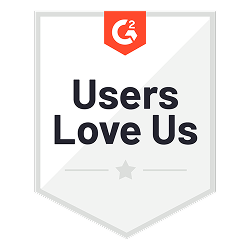

Automate recoverable VAT on your expense reports

Boost your cash flow with automatic detection of recoverable VAT on every receipt.

- No more manual calculations

- Fewer tax errors

- Smooth, compliant VAT management for all your business expenses

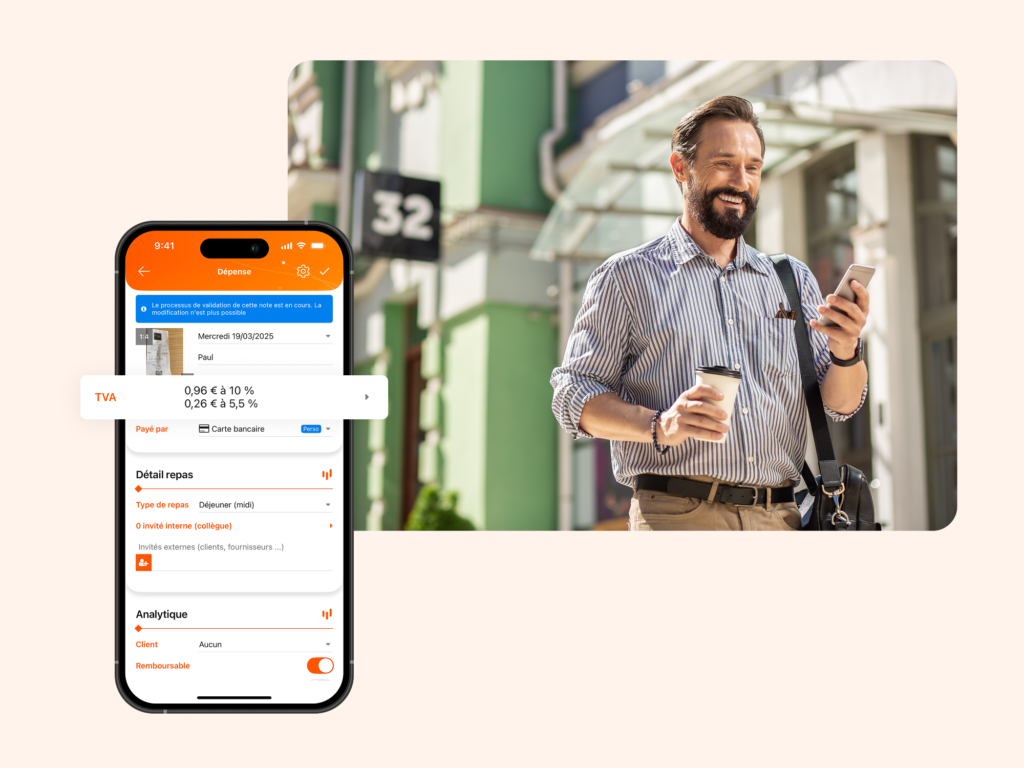

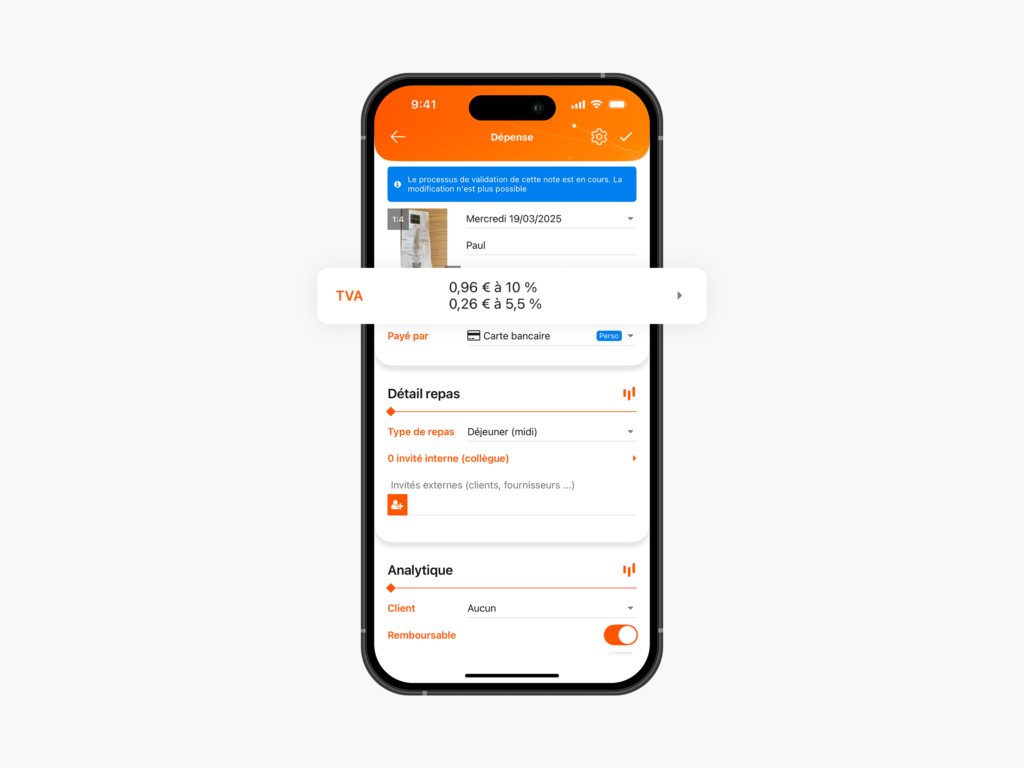

Smart VAT capture

Your ideal assistant for VAT recovery

Accurate

N2F automatically detects and extracts VAT amounts from every invoice and receipt, ensuring reliable identification of recoverable VAT.

Fast

VAT data is captured instantly, cutting manual entry and speeding up your accounting processes.

Comprehensive

Handles complex VAT cases, including mixed rates, exemptions, and partial recovery.

Efficient

Reduce errors and accelerate VAT recovery, saving your finance team valuable time.

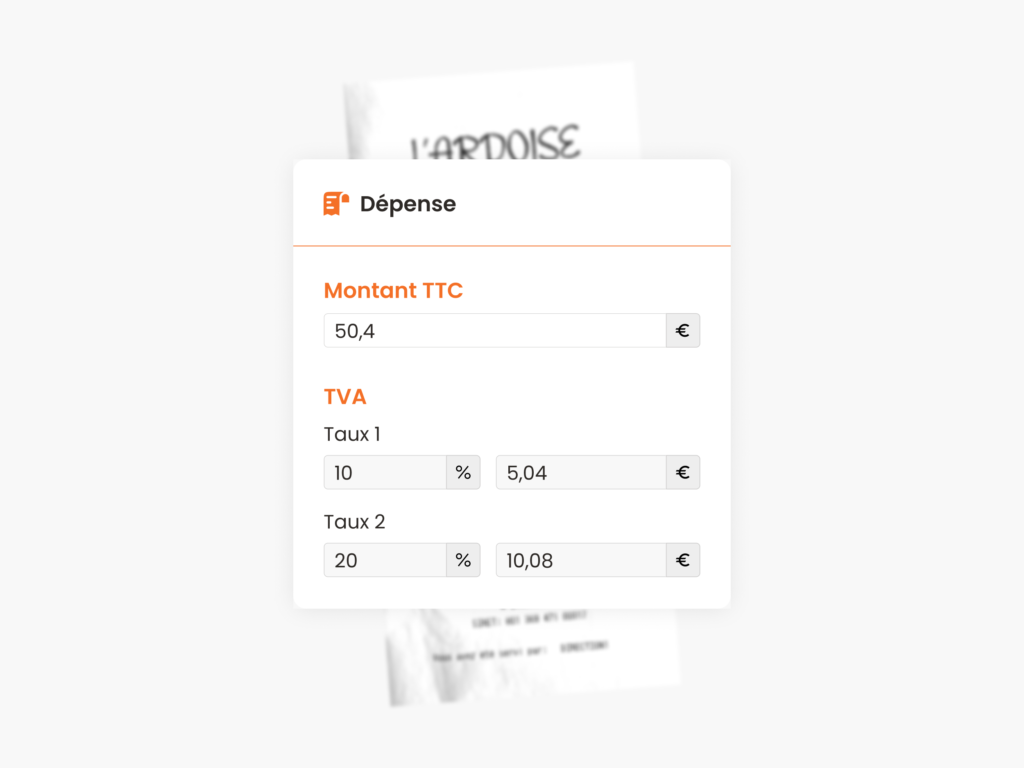

Automated VAT compliance

Ensure total VAT recovery and compliance

Reliable

N2F applies the latest French VAT rules to accurately distinguish recoverable from non-recoverable VAT.

Transparent

Get a detailed VAT breakdown for every expense, making reporting and audits easy.

Flexible

Customize VAT rules to match your internal policies and regulatory changes.

Secure

All VAT data is safely archived with full traceability for audits and tax checks.

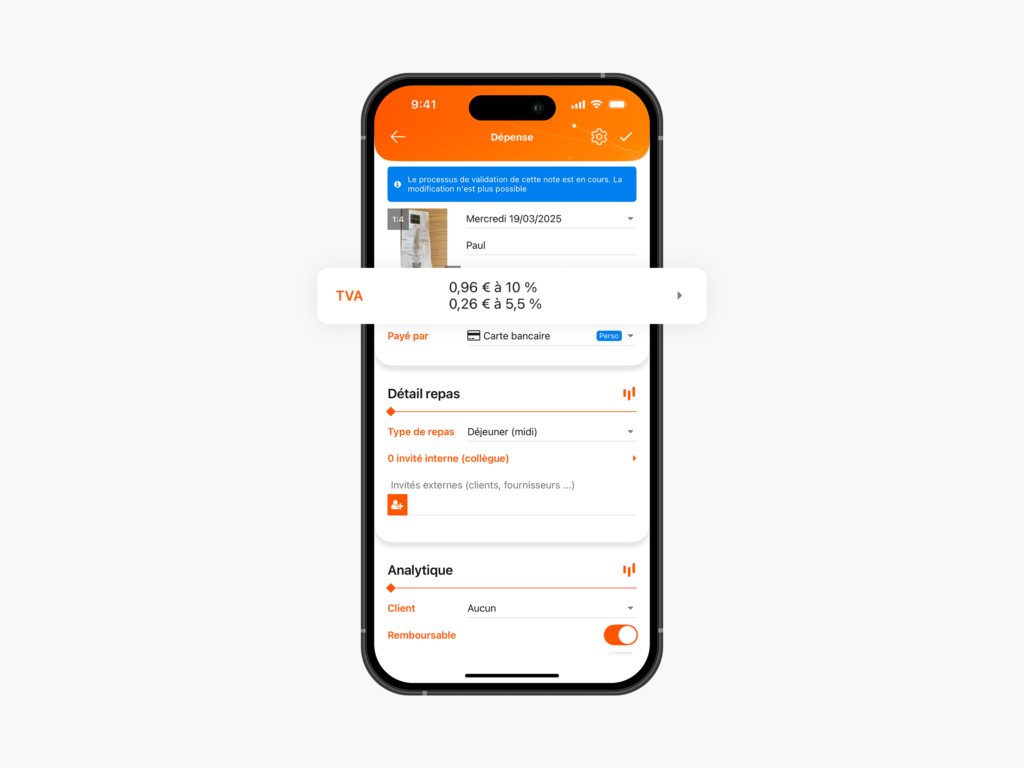

All types of VAT covered

Manage every VAT type, no manual work needed

Comprehensive

N2F supports all VAT types for fully compliant, end-to-end expense management.

Recoverable

VAT on business purchases, fully deductible.

Partially recoverable

Special cases like mixed-use vehicles with partial recovery.

Non-recoverable

Expenses excluded from deduction, such as certain non-business charges.

Time savings for every organization

Why automate recoverable VAT management?

Features designed for accountants

Discover N2F expense report features

Book your personalized demo

A solution built for every organization: see how N2F can boost your teams and accounting efficiency.