Automate bank reconciliation

Thanks to Smart Transaction Tracking, every payment is instantly matched with its receipt. Track your expenses in real time and eliminate manual tasks.

Request a demo

BANK RECONCILIATION

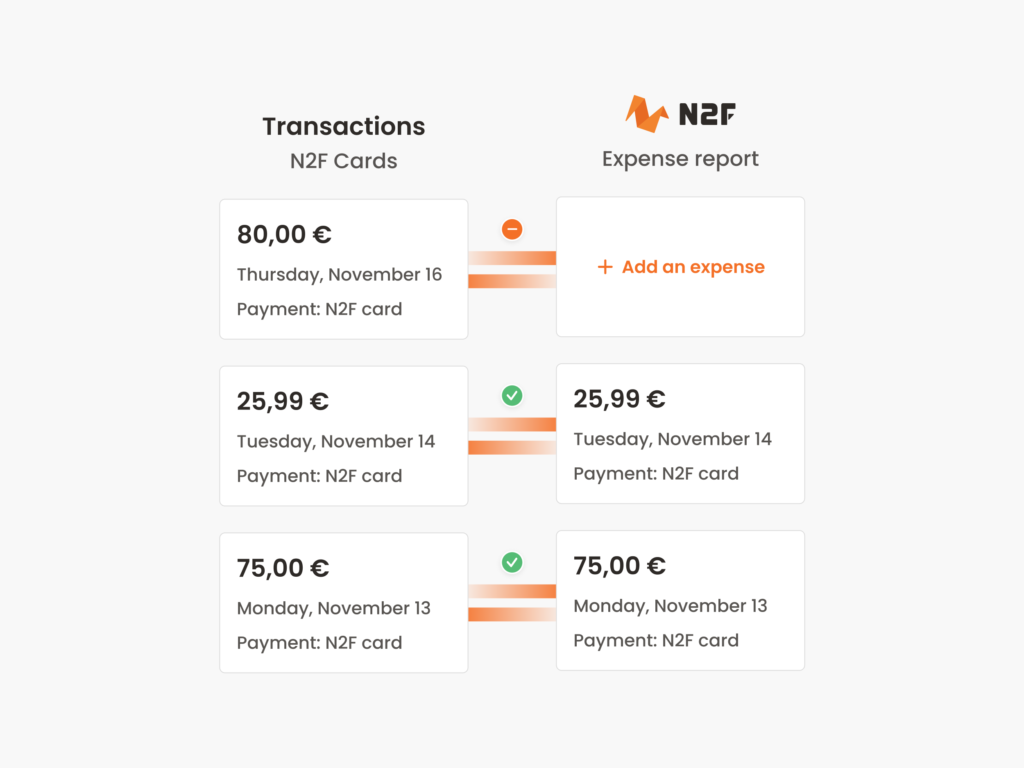

Automatic transaction reconciliation

Smart Transaction Tracking

Each transaction is automatically matched with its receipt upon payment.

Instant notifications

Users are alerted to add their receipt, with no delay or risk of forgetting.

Discrepancy detection

Differences between paid and received amounts are flagged in real time.

Simplified accounting preparation

Data is ready for export, without manual processing.

PAYMENT SECURITY

Proactive detection of discrepancies and fraud

Anomaly detection

Errors, duplicates, and inconsistencies are automatically identified.

Real-time alerts

Each irregularity triggers a notification to the appropriate contacts.

Fraud monitoring

The system identifies suspicious behavior and unusual transactions.

Enhanced validation

Sensitive transactions can undergo a dedicated verification step.

ACCOUNTING INTEGRATION

Simplified accounting export

Automatic export to accounting

Validated expenses are ready to be exported to your software or ERP.

Customizable formats

PDF, CSV, or API integration — choose what fits your organization.

Zero manual entry

All data is already categorized and validated before export.

Automated bank reconciliation

Why automate bank reconciliation with N2F?

Go further with N2F cards

Discover additional N2F card features

Book your personalized demo

A solution built for every organization. See how N2F can streamline work for your teams and your finance department