Automate accounting integration of your expense reports

Connect your expense management to your accounting environment with no manual entry or errors. Thanks to N2F’s customizable exports, all your data flows are ready to be imported into your accounting software or ERP

- No more manual entry

- Fewer errors in journal entries

- Exports ready for accounting, payroll, or payments

Accounting integration and recoverable VAT

Automatically export your accounting entries

N2F integrates with major accounting software and ERP systems such as QuickBooks and Xero. Your accounting entries are generated directly in the format accepted by your ecosystem.

Explore integrationsReady-to-use accounting entries

Automate your accounting exports with ease

Compatible

Whether you use Sage, Cegid, SAP, EBP, or any other major software, N2F adapts to your accounting environment

Customizable

With the “Export factory” tool, configure your exports to fit your needs: accounts by expense type, employee, VAT rate, custom labels, and more

Automated

Accounting entries are generated automatically, reducing errors and tedious manual tasks

Efficient

Save time by avoiding data re-entry and ensure smooth integration with your accounting system

Recoverable VAT

Simplify your recoverable VAT management

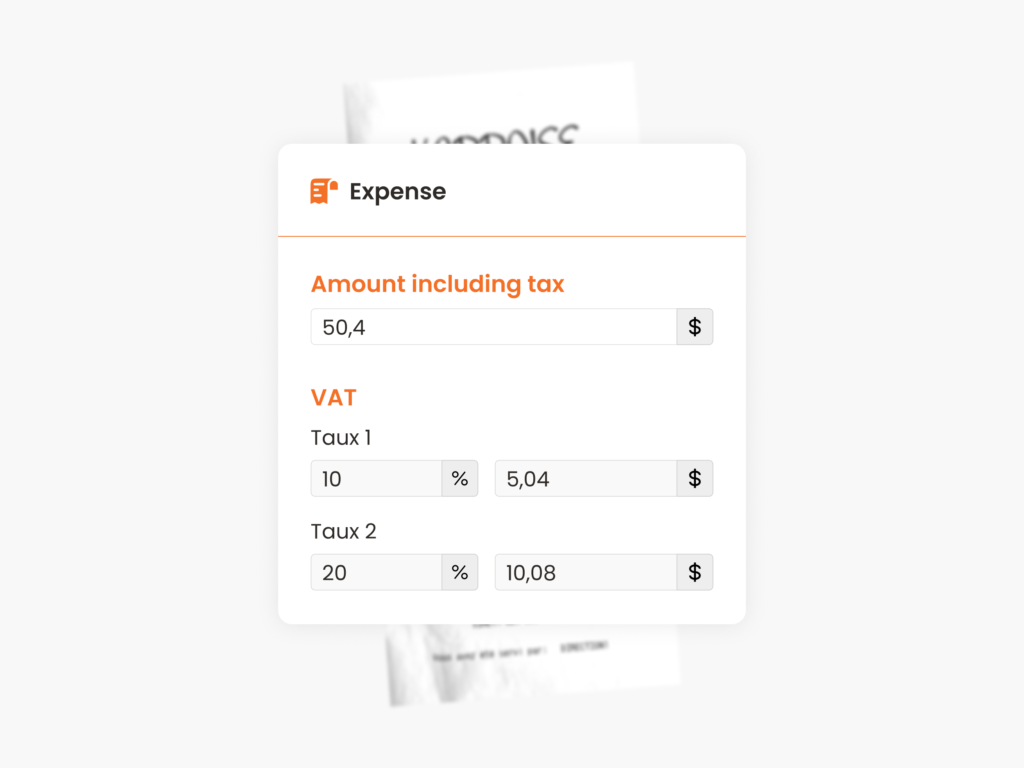

Automatic calculation

Recoverable VAT is calculated automatically, including cases with multiple rates or specific fuel rules

Accurate allocation

Amounts are allocated across tax and expense accounts simply and automatically

Guaranteed compliance

Meet VAT tax obligations effortlessly with integrated and reliable management

Time savings

Avoid manual calculations and tedious checks by relying on a solution that handles VAT for you

Features designed for accountants

Other N2F expense report features

Book your personalized demo

A solution built for all organizations: see how efficient N2F can be for your teams and accounting.