TRAVEL EXPENSES

Calculate mileage costs

Reimbursement scales for mileage allowance

With N2F, opt for the integrated tax scale or for a personalized scale, depending on the policy chosen to manage your company’s travel expenses.

You use the tax mileage scale (tax)

Business travel generates a certain number of mileage-related expenses: fuel costs, wear and tear, etc.

To cover these costs, the tax authorities publish an annual tax scale of mileage allowances. But you don’t need to learn these by heart: N2F integrates them natively!

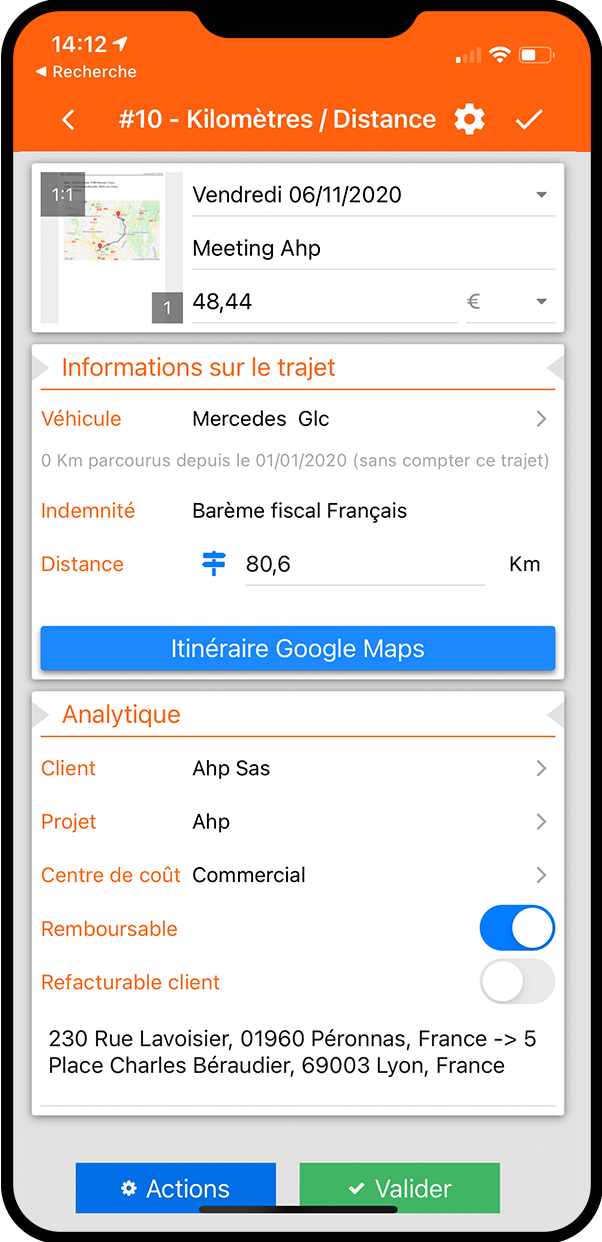

The mileage allowance is calculated automatically based on the tax horsepower of the vehicle used and the distance travelled.

You use your own scale

Your company has opted for a fixed scale? N2F allows you to customize the scale to be applied per vehicle in a few clicks.

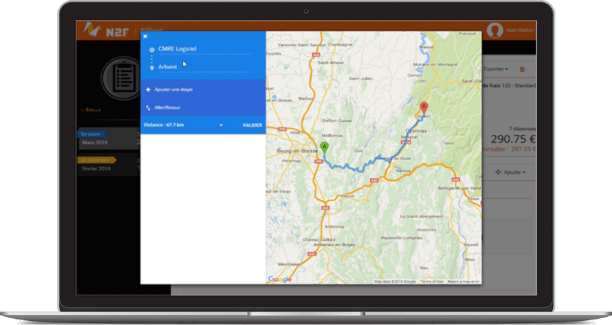

Use the Google Maps module to faciliate the entry of mileage expenses

Forgot to read your milometer at the start or end of your trip? Don’t worry, N2F includes a Google Maps module that calculates the distance traveled.

Avoid time-consuming address entry: simply enter the company name and location and the Places module automatically fills in the address. For an efficient visualization of the journey, the route is shown on the map. Do your employees make return journeys? Do the journeys include several legs?

N2F manages all scenarios and offers intuitive entry for the characteristics of each route.

Your employees can concentrate on their travel, N2F will take care of their expenses.

Optimize the management of your business expenses

BUSINESS EXPENSES are generally monitored closely. How about a little help?

Save time by recording your favorite routes Do you visit your main customer every month? Avoid repetitive entries: customize your favorite routes in 3 clicks. When you enter your MILEAGE EXPENSE request, you just have to select your preferred route and everything is automatically filled in for you: description, mileage, etc.

Deduction of distance between home and work If your employees leave from (or return to) home when they visit customers, the home-to-work distance will be deducted from their reimbursement via the “Leave from home” or “Direct return to home” choices.

Calculating recoverable VAT for fuel expenses When your employees use a company car for their business travel, you can recover the VAT on fuel. The percentage recovery depends on the power and the type of vehicle. There’s no need to waste time on these calculations anymore. With N2F, it’s very simple as the recoverable VAT is calculated automatically.

Management of all types of vehicle Personal, service or company vehicles – all cases are managed by N2F. Your employees can travel with peace of mind, their favorite vehicle will be selected by default. You have a summary vision of your fleet and can prepare high-quality reports.

Not enough time to read it all? Summary Travel expenses in N2F:

During their business trips, your employees incur a certain number of expenses:

mileage costs, meal costs, toll charges, fuel charges if they use a company vehicle, etc.

They clearly want to be quickly reimbursed for the expenses incurred.

And you want to efficiently manage your employee’s claim for reimbursement.

With N2F, speed up and facilitate all your expense reimbursement procedures.

- Reimbursement of mileage expenses (personal vehicle)

- Choice of scale: tax mileage scale or personalized mileage scale (there’s no need to look up how to calculate the mileage allowance anymore!)

- Automatic calculation of distances and round trips thanks to the Google Maps module (no more mileage calculations!)

- Option to deduct the home-work journey

- Personalization of favorite routes and vehicles

- Reimbursement of fuel expenses (company vehicle)

- Recoverable VAT calculated automatically

In addition, thanks to our data analysis module, you will be able to monitor your fleet of vehicles very precisely

(distance traveled, amounts reimbursed, fuel consumption, etc.).

By choosing N2F, the reimbursement of travel expenses has never been easier.

You want an overview of the full N2F expense report app?

Mobile app and Smart scan

Mobile app and Smart scan  Legal compliance archiving

Legal compliance archiving  Company cards

Company cards  Accounting export and VAT

Accounting export and VAT  Per diem and mileage allowances

Per diem and mileage allowances  Workflows and Reporting

Workflows and Reporting  Travel request & advance payments

Travel request & advance payments  Blog

Blog  Client case studies

Client case studies  Team

Team  Careers - our job offers

Careers - our job offers  Our partners

Our partners  Contact us

Contact us  Attend a demo

Attend a demo

Need more

Need more