FRAIS DE DÉPLACEMENT

Calcul frais kilométrique

Barèmes de remboursement indemnité kilométrique

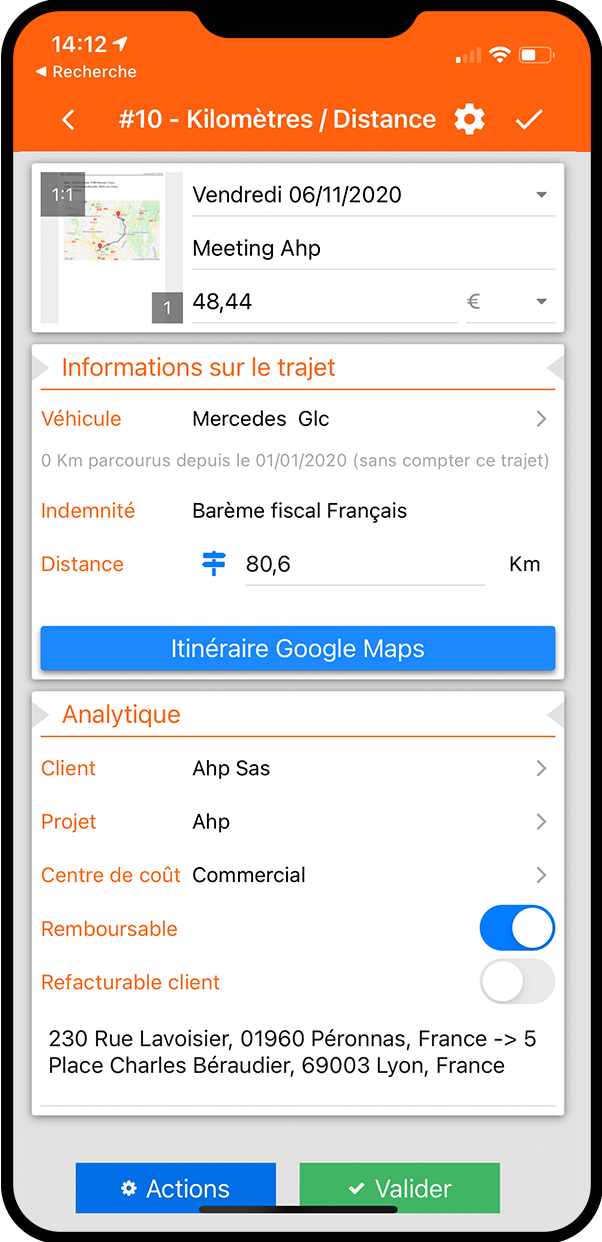

Avec N2F, optez pour le barème fiscal intégré ou pour un barème personnalisé, selon la politique choisie pour la gestion des frais de déplacement de votre entreprise.

Vous utilisez le barème kilométrique fiscal (impôt)

Les déplacements professionnels engendrent un certain nombre de frais kilométriques : frais de carburant, frais d’usure…

Pour couvrir tous ces frais, l’administration fiscale publie chaque année le barème fiscal d’indemnité kilométrique. Nul besoin cependant de le connaître sur le bout des doigts : N2F l’intègre nativement !

L’indemnité kilométrique est ainsi automatiquement calculée en fonction de la puissance fiscale du véhicule utilisé et du nombre de kilomètres parcourus.

Vous appliquez votre propre barème

Votre entreprise a opté pour un barème fixe ? N2F vous permet de personnaliser le barème à appliquer par véhicule en quelques clics.

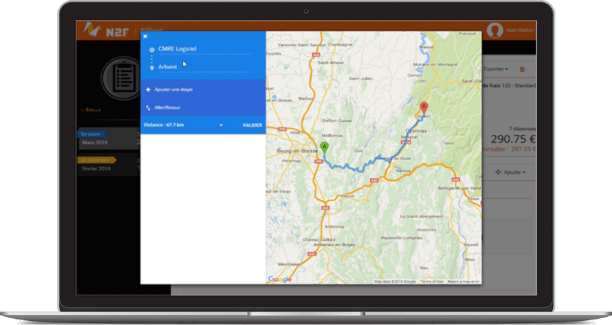

Facilitez la saisie de frais kilométrique via le module Google Maps

Vous avez oublié de relever votre compteur kilométrique au départ ou à l’arrivée de votre voyage ?

Ne vous inquiétez pas, N2F intègre un module Google Maps qui calcule la distance parcourue pour vous.

Evitez les saisies fastidieuses d’adresses : indiquez simplement le nom de l’entreprise et le lieu et le module « Places » remplit automatiquement l’adresse. Pour une visualisation efficace du déplacement, le trajet est tracé sur la carte.

Vos collaborateurs réalisent des allers-retours ? Les trajets comprennent plusieurs étapes ?

N2F gère tous les cas de figures et propose une saisie intuitive des caractéristiques de chaque trajet.

Vos collaborateurs peuvent se concentrer sur leur déplacement professionnel ou leur voyage d'affaires, N2F s’occupe de leurs frais.

Optimisez la gestion de vos frais professionnels

Les FRAIS PROFESSIONNELS sont généralement suivis avec beaucoup d’attention. Que diriez-vous d’un peu d’aide ?

Gagnez du temps en enregistrant vos trajets favoris

Vous rendez visite tous les mois à votre client principal ?

Evitez les saisies répétitives : personnalisez vos trajets favoris en 3 clics. Lorsque vous saisissez votre demande de frais kilométrique, vous n’avez qu’à sélectionner votre trajet de prédilection et tout se remplit automatiquement : description, nombre de kilomètres…

Déduction distance domicile travail

Si vos collaborateurs partent (ou rentrent) de chez eux pour rendre visite à des clients, la distance domicile – travail sera déduite de leur remboursement grâce aux choix « Départ de mon domicile » ou « Retour direct à mon domicile ».

Calcul de la TVA récupérable pour les dépenses de carburant

Lorsque vos collaborateurs utilisent un véhicule de société pour leur déplacement, il est possible de récupérer la TVA sur le carburant. Le pourcentage de récupération dépend de l’énergie et du type de véhicule. Ne vous embarrassez plus avec ces calculs, dans N2F, c’est très simple puisque la TVA récupérable est automatiquement calculée.

Gestion de tous types de véhicule

Véhicules personnels, de service ou de fonction, tous les cas sont gérés par N2F. Vos collaborateurs peuvent se déplacer l’esprit tranquille, leur véhicule favori est sélectionné par défaut. Vous obtenez ainsi une vision synthétique de votre flotte et pouvez effectuer des reportings de qualité.

Vous l'avez compris, les indemnités kilométriques dans N2F c'est... Facile et rapide !

Lors de leurs déplacements à titre professionnel, vos collaborateurs engagent un certain nombre de frais : frais kilométriques, frais de repas, frais de péage, frais de carburant s’ils utilisent un véhicule de société…

Ce qu’ils souhaitent, c’est bien entendu obtenir rapidement le remboursement des frais engagés.

Ce que vous souhaitez, c’est gérer efficacement la demande de remboursement émanant de votre collaborateur.

Avec N2F, accélérez et facilitez toutes les procédures de remboursement des frais.

- Remboursement des frais kilométriques (véhicule personnel)

- Choix du barème : barème kilométrique fiscal ou personnalisé (plus besoin de chercher comment calculer l’indemnité kilométrique !)

- Calcul automatique des distances et trajets aller-retour grâce au module Google Maps (plus de kilomètre à calculer !)

- Possibilité de déduire le trajet domicile travail

- Personnalisation des trajets et véhicules favoris

- Remboursement des frais de carburant (véhicule de société)

- TVA récupérable automatiquement calculée

De plus, grâce à notre module d’analyse de données, vous pourrez suivre très précisément votre flotte de véhicules

(km parcourus, montants remboursés, consommation de carburant …).

En choisissant N2F, le remboursement des frais de déplacement n’aura jamais été aussi simple.

Vous souhaitez obtenir un aperçu synthétique de toute l’application note de frais N2F ?

Besoin

Besoin